Thomas Schäfer, Volkswagen Group Board of Management Member responsible for the Brand Group Core: “Overall, the Brand Group Core results show we are on the right track, but still have a great deal of potential – in the individual brands and as a Brand Group. We cannot and should not be satisfied with our current profitability – decisive counteraction is called for here. The only real response to the difficult environment and the fundamental technological transformation is even closer cooperation between our brands. We are creating the space required for the necessary investments in the future through synergies, by bundling competences and with our efficiency programs. The goals, priorities and responsibilities within the Brand Group are in place, now we are shifting up another gear in the joint implementation.”

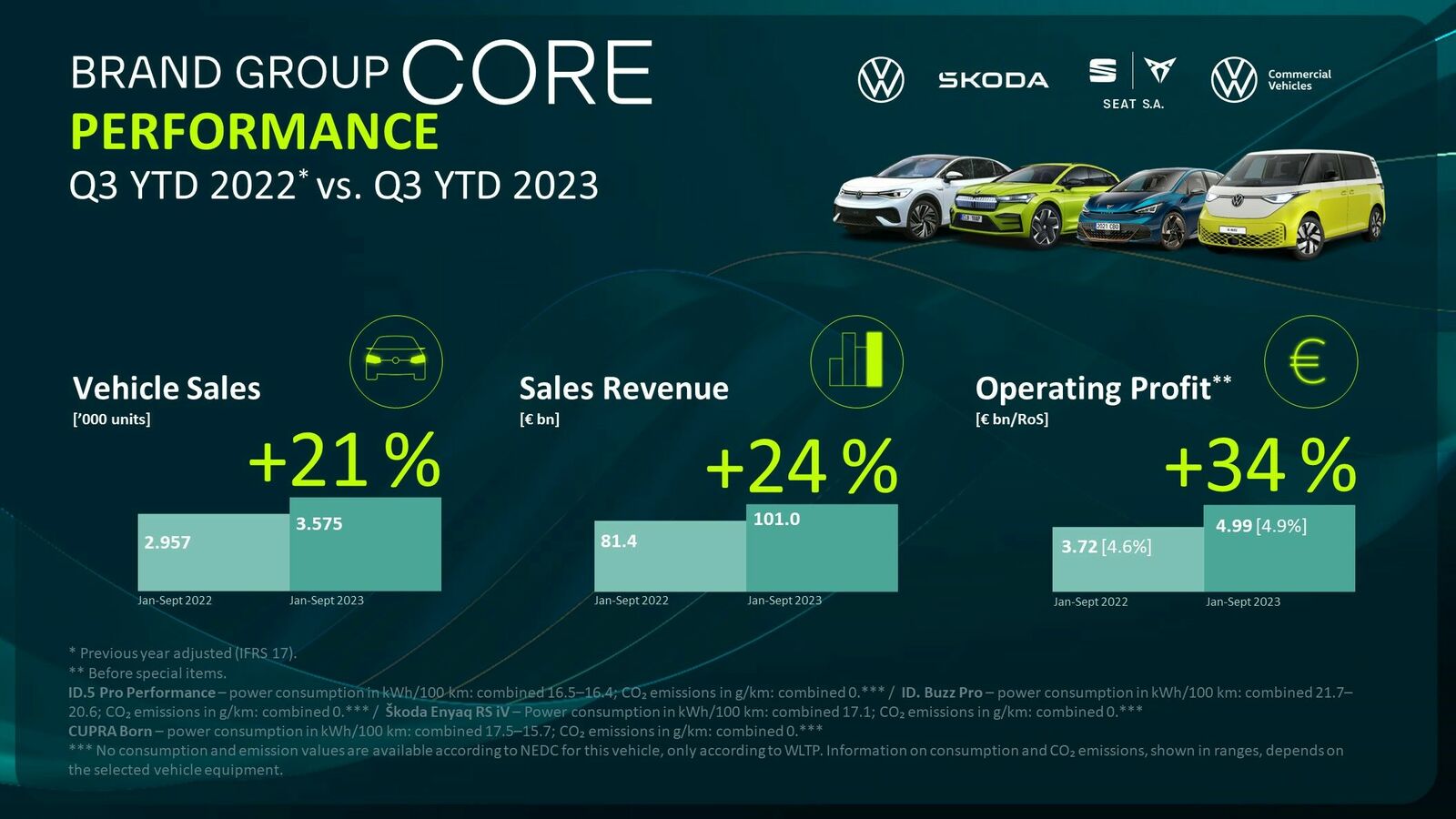

The Brand Group Core’s performance from January to September 2023 reflects the convergence of the five brands. The operating profit before special items improved by 34.0 percent compared to the same prior-year period, coming in at 4.99 billion euros (Q3 YTD 2022: 3.72 billion euros). Net cash flow improved on the prior-year figure (Q3 YTD 2022: 1.86 billion euros) and increased to 3.57 billion euros. The operating return on sales before special items of 4.9 percent only increased by 0.3 percentage points (Q3 YTD 2022: 4.6 percent) due to offsetting effects. Sales revenue grew by 24.0 percent to 101.06 billion euros (Q3 YTD 2022: 81.36 billion euros).

While synergies and cost management had a positive impact on financial performance, the Brand Group also reported increased unit sales (+21.0 percent) to a cumulative figure of 3.57 million vehicles (Q3 YTD 2022: 2.96 million vehicles), attributable to an overall upswing in demand. The Brand Group also saw deliveries rise: 4.82 million units were handed over to customers in the first three quarters of 2023, an increase of 9.4 percent compared to the same prior-year period (Q3 YTD 2022: 4.41 million vehicles). As regards battery-electric vehicles, the industry is currently experiencing a general reluctance to buy battery-powered models. The overall market trend here fell short of expectations.

Patrik Andreas Mayer, CFO of the Volkswagen brand and responsible for Finance at the Brand Group Core: “Our results after nine months confirm the effectiveness of the new steering model in the Brand Group Core. We have identified the levers and are on the right track to improving our performance step by step. With our efficient cost management, we are targeting a full-year return on sales that is higher than the previous year, despite the unexpected challenges of the third quarter. Our long-term target for the Brand Group Core’s operating return on sales remains unchanged at an ambitious 8 percent.”

Key figures for the Brand Group Core:

Key financials | Jan - Sep 2023 | Jan - Sep 2022 | Change 23/22 |

Unit sales | 3,574,700 vehicles | 2,957,400 vehicles | +21% |

Sales revenue | 101.060 billion euros | 81.356 billion euros | +24% |

Operating profit before special items | 4.985 billion euros | 3.720 billion euros | +34% |

Operating return on sales before special items | 4.9% | 4.6% | +0.3%-points |

Net cash flow | 3.573 billion euros | 1.855 billion euros | +92.7% |

The overall performance of the Brand Group Core is also attributable to the systematic development of the individual brands Volkswagen, ŠKODA, SEAT/CUPRA and Volkswagen Commercial Vehicles.

Interruptions in production due to reduced component availability and significantly higher product costs had a noticeable negative impact on the Volkswagen brand’s Q3 operating profit of 2.13 billion euros (prior-year period: 2.46 billion euros). As a consequence, the operating return on sales before special items for the current year came in at 3.4 percent – 1.4 percentage points weaker than the figure for the same period last year. At the same time, the industry is experiencing a general reluctance to buy battery-powered vehicles. The overall market trend in this sector fell short of expectations. The Volkswagen brand grew unit sales by 19.0 percent overall in the first three quarters. The current figure for the brand this year is 2.24 million vehicles, compared to 1.88 million in the same prior-year period. Sales revenue increased by 22.0 percent from 52.03 billion euros in the first nine months of 2022 to 63.40 billion euros in the same period in 2023.

ŠKODA Auto recorded continued growth in the first three quarters of the year and reported positive results for all key performance data. At 1.26 billion euros, the operating profit before special items grew by 47.2 percent compared with the same period in 2022, while the return on sales increased to 6.4 percent (2022: 5.6 percent). The robust trend in unit sales of the all-electric Enyaq model (+47.6 percent) was a significant factor in this positive development. ŠKODA delivered 777,500 vehicles worldwide (+20.5 percent) in the period under review.

At 454,300 vehicles, SEAT/CUPRA recorded a sharp rise of 36.5 percent in unit sales from January to September 2023. At 501 million euros, operating profit before special items was 512 million euros higher than the comparable prior-year period. The return on sales came in at 4.6 percent (previous year: -0.1 percent). Sales revenue increased to 10.84 billion euros, 38.6 percent higher than the comparable prior-year period. As a result, the company reported its best third quarter ever.

Volkswagen Commercial Vehicles (VWN) also systematically continued its positive business development in the third quarter of the current year. Unit sales grew by 32.0 percent compared with the same prior-year period to 312,600 vehicles (prior year: 236,800). All world regions where VWN is active recorded year-on-year growth. Deliveries of the all-electric ID. Buzz grew steadily as the year progressed, and as a result VWN reported a BEV share of 6.5 percent in the third quarter of 2023. Sales revenue grew by 40.0 percent to 11.10 billion euros (previous year: 7.96 billion euros)

due to positive delivery and unit sales figures. Operating profit before special items increased to 672 million euros as a result of continued systematic cost and efficiency efforts, and was therefore 88.4 percent higher than the comparable period in 2022 (356 million euros). As a result, the return on sales climbed further to 6.0 percent, a noticeable increase on the figure for the previous year (4.5 percent).